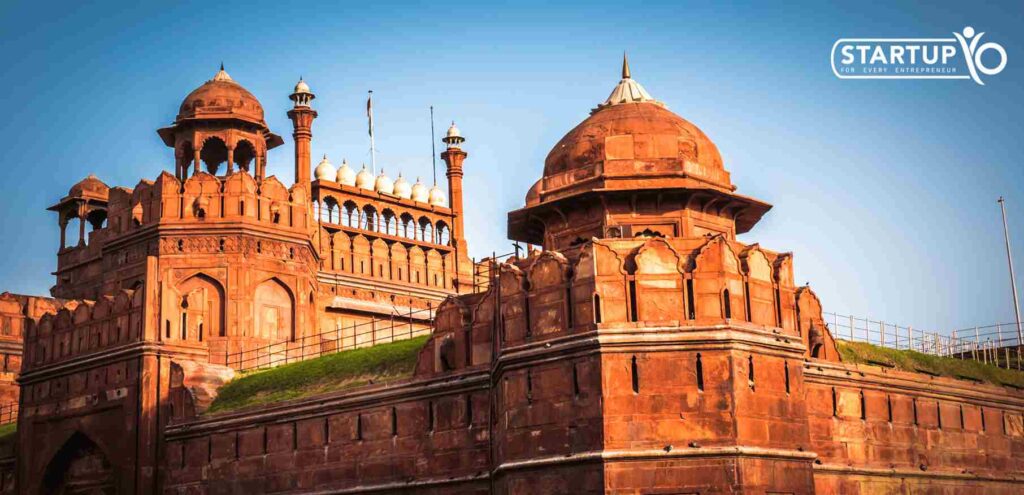

Gateway to Growth: Company Registration in Delhi

Company registration in India is essential since it provides the world’s best business opportunity. First of all, it gives the corporate entity legal status and protection, insulating the owners from personal liability. Second, it makes it simpler for the business to obtain loans, draw in investors, and sign contracts by increasing its credibility and trustworthiness. Thirdly, registration guarantees adherence to tax rules, promoting efficient operations and averting legal snags. To qualify for a business loan in Delhi, you must first register your company.

Furthermore, it offers a range of advantages and incentives the government offers to registered businesses, such as tax exemptions and subsidies, encouraging growth and development. In general, a stable and prosperous business idea in Delhi is built on the foundation of company registration.

Essential Documents Required for Company Registration in Delhi

Depending on the form of company you wish to create (such as a Private Limited, Limited Liability Partnership, Sole Proprietorship, etc.) and the nature of your business, the particular paperwork needed for company registration in Delhi may change. However, the following typical documents are frequently required for company registration.

- Identity and Address Proof of Directors/Partners/Proprietor: Identity documentation options include a passport (for foreign nationals), an Aadhar card, a voter ID, or a driver’s license. As address verification, you can use your passport, Aadhar card, voter ID, or most recent utility bills.

- PAN Card: Permanent Account Number (PAN) card of all directors/partners/proprietors.

- Registered Office Proof: Rental agreement or sale deed of the registered office premises. Utility bills (electricity, water, or gas bills) with the address of the registered office.

- MOA and AOA: Memorandum of Association (MOA) and Articles of Association (AOA) of the company.

- DIN or DPIN: Director Identification Number (DIN) for directors or Designated Partner Identification Number (DPIN) for partners.

- Digital Signature Certificate (DSC): DSC for one of the directors/partners for online filing.

- Declaration of Compliance: A declaration that all the requirements are according to the Delhi Shops and Establishment Act.

- Payment Receipts: Receipts of the fee paid for company registration and stamp duty.

- Other documents: Depending on the kind of business and the activities it engages in, additional documentation can be needed. These may contain letters of approval from the landlord, directors’ or partners’ agreements, and more.

Company Registration Process in Delhi: A Step-by-Step Guide

A corporate entity in Delhi, India, is given formal recognition and legal standing by the government through the company registration process. The registration procedure is governed by rules established by the Ministry of Corporate Affairs (MCA) and the Registrar of Companies (ROC), which is particularly important given that Delhi is India’s capital city and a popular site for businesses.

Read More: Documents Required For Company Registration

Here is a quick overview of Delhi’s company registration procedure

- Choose the Type of Company: The first step is deciding on the type of company structure you want to register. Popular options include limited liability partnerships (LLP), one-person businesses (OPC), private limited companies, and public limited companies.

- Name Approval: Make sure your company name complies with the naming guidelines before choosing it. The name shouldn’t be the same as the name of another company and should follow legal regulations.

- Digital Signature Certificate (DSC): Obtain the digital signature certificate of potential directors or partners. The prerequisite for filing electronically is this.

- Director Identification Number (DIN): If you don’t already have a Director Identification Number (DIN), Directors’ DINs are as follows: Apply for a DIN if you don’t already have one. Company directors have a special identifying number known as a DIN.

- Prepare Documents: Compile the required paperwork, including the directors’ or partners’ passport-sized photos and documents proving their identities and addresses.

- File for Registration: Apply with the ROC in Delhi to register a business. This entails completing paperwork, making the necessary payments, and supplying the required paperwork.

- Approval and Certificate: Application and Certificate: You will obtain a Certificate of Incorporation once the ROC has examined and approved your application. This Certificate formally establishes your company.

- PAN and TAN: For your business, submit applications for a Permanent Account Number (PAN) and a Tax Deduction and Collection Account Number (TAN).

- Bank Account: To perform financial transactions, open a bank account in the name of the business.

- Compliance: Ensure that certain legal requirements, such as keeping records, holding annual meetings, and filing annual returns, are followed.

- GST Registration: Consider GST registration in Delhi if your company offers both goods and services.

To make sure you adhere to all legal rules and laws, it is imperative to seek professional help, such as from a chartered accountant or a company secretary, during the business registration procedure in Delhi. It’s important to be informed because the procedure can alter based on the type of business and modifications to governmental legislation.

Cost of Registering a Company in Delhi

| Steps | Cost (Rs) |

| Government Fees | 5,000 to 7,000 ₹ |

| Professional Fees | 4000 to 5,000 ₹ |

| Stamp Duty | 100 to 500₹ |

| Name Reservation | 1,000₹ |

| Incorporation Documents | 500 to 1,000₹ |

The cost of Company Registration in Delhi, India can vary depending on the type of company (Private Limited, Limited Liability Partnership, etc.) and several other factors. The cost can include

- Government Fees: These fees depend on the authorized capital of the company.

- Professional Fees: You might need to hire a Chartered Accountant or Company Secretary to help with the registration process. Their fees can vary.

- Stamp Duty: This is based on the state in which the company is registered and the authorized capital.

- Name Reservation: To check the availability and reserve the company name, a fee is charged.

- Incorporation Documents: Expenses for writing the articles of association and memorandum of association.

Read More: How to register a One Person Company online in India?

Why StartupYo for Company Registration

Compared to conventional offline procedures, online companies like StartupYo offer Company Registration in Delhi services with the following benefits

- Convenience: StartupYo online registration services spare you from having to leave the comfort of your home or workplace to finish the registration process.

- Speed: The digital input of documents and information occurs during StartupYo online registration, the processes are often completed more quickly. By doing this, the time needed for Company Registration in Delhi can be greatly shortened.

- Cost-effective: StartupYo registration services may be more economical because they frequently offer competitive pricing and don’t require hiring outside consultants or incurring travel costs.

- Accessibility: StartupYo registration services are available around the clock, making them more convenient for people with demanding schedules.

- Document Management: StartupYo frequently offers digital storage and simple access to your registration records, lowering the likelihood that crucial paperwork will be lost.

- Expertise: StartupYo has knowledgeable staff members who can walk you through the procedure and make sure all standards are satisfied.

- Updates and Notifications: StartupYo services can notify you promptly of crucial filing deadlines, compliance needs, and regulatory changes.

- Customer Support: StartupYo provides customer help via phone, chat, email, and other channels to handle your questions and problems.

- Streamlined Processes: These services often have user-friendly interfaces and tools that simplify the registration process, making it easier for individuals who may not be familiar with the complexities of business registration.

- Compliance Assistance: After registering, StartupYo could provide continuous compliance services to assist you in maintaining compliance with tax, legal, and regulatory requirements.

StartupYo is regarded as one of the best service providers in India, which can guide you step by step on how to start a business in India However, it’s essential to choose a reputable agency and verify their credentials and reviews to ensure they provide reliable services. Additionally, the suitability of online registration may vary depending on your specific location and the nature of your business, so it’s advisable to research and consider your options carefully.

Conclusion

For business owners and entrepreneurs seeking to form a legal organization in India’s capital city, the Company Registration in Delhi is an essential first step. It provides several advantages, such as legal defense, entry to a sizable market, and respectability in the corporate world, especially for small business ideas in India. However, navigating the complicated regulatory landscape can be difficult, therefore it is frequently advisable to seek professional guidance. Entrepreneurs can effectively register their firms in Delhi and begin their journey to business success in this vibrant and active metropolis with the appropriate counsel and attention to the required regulations.

FAQ’s

What types of companies can be registered in Delhi?

One-person companies (OPCs), limited liability partnerships (LLPs), private limited companies, and public limited companies are just a few of the business entities that can be registered in Delhi.

What are the basic requirements for company registration in Delhi?

Depending on the sort of company, you must have a distinct name, a registered office in Delhi, and a minimum number of directors or partners.

How long does it take to register a company in Delhi?

The length of the registration process varies depending on the type of business and the thoroughness of your application, but it usually lasts between 10 and 15 working days.

Is it mandatory to have a physical office in Delhi for company registration?

Yes, you must present address verification and have a registered office in Delhi.