A Closer Look: What is GST and Its Key Features

In nations that have enacted the Goods and Services Tax (GST), such as India, Canada, and Australia, the term “GST” refers to the registration process. documents required for Gst registration At every level of manufacturing or distribution, sales of goods and services are subject to the consumption-based GST tax.

The essential details about GST registration involves

Legal prerequisites : In many nations, companies must register for GST by law if their annual sales reach a specific level. This limit may differ from one nation to another.

Input Tax Credit : Businesses that are GST-registered may deduct the GST they paid on purchases (input tax credit) from the GST they were required to pay on sales (output tax). This is intended to be a more effective and fair tax system by removing the cascading effect of taxes.

Compliance : Once registered, companies must submit frequent GST returns, often every month or every three months, depending on the laws of the jurisdiction. They must disclose all sales, purchases, and GST gathered and paid.

GST Number : A business receives a special GST number check after successfully registering, and this number needs to be listed on invoices and other financial documents.

Penalties : Legal repercussions may occur from failing to register for GST when necessary or failing to follow GST requirements.

Volunteer Registration : Businesses who don’t meet the turnover requirement occasionally have the option of voluntarily registering for GST. If they want to claim input tax credits or if they are a part of a supply chain with other registered businesses for GST, this may be helpful.

Multiple Registrations : Given that GST rates and rules might differ depending on the state or location a business operates in, some companies may need to acquire several GST registrations.

To stay out of trouble with the law and maintain efficient operations, businesses must be aware of their GST requirements, register as needed, and abide by all applicable tax rules. documents required For Gst registration accurate navigation of the process, it’s vital to seek advice from the tax authorities or a tax professional as the precise regulations and procedures for GST registration validity can differ greatly between nations.

Read More : What is the GST council and its functions?

Essential Documents Required for GST Registration

In general, the following are the frequently requested documents required for GST registration while specific requirements may differ by country

Id Verification : This can be your voter ID, passport, PAN (Permanent Account Number), or Aadhar card.

Evidence of Address : You can provide evidence of address using documents like your passport, Aadhar card, driver’s license, or utility bills.

Photographs : Depending on the form of your company, passport-sized photos of the owner, partners, or directors.

Business Registration Documents : You might require papers like the Certificate of Incorporation, Partnership Deed, or Registration Certificate depending on the type of your business.

Bank Account Details : A bank statement or cheque showing the name, address, and account number of your company.

Letter of Authorization : An authorization letter may be required if someone else is submitting the application on your behalf.

Digital Signature Certificate : In some circumstances, a DSC may be required for online submission.

Letter of Agreement (for SEZ Units) : You might require this document if your business is located in a Special Economic Zone (SEZ).

Additional documents : Additional documentation that can be needed, depend on the nature of your operations and the type of business you operate.

The specific rules and instructions supplied by the GST authorities in your nation should be carefully reviewed because they are subject to change. To make sure you have all the required paperwork for a seamless documents required for GST registration process, you might also wish to speak with a tax expert or CA (Chartered Accountant).

Read More : How to Download GST Registration Certificate ?

Quick Steps: How to Apply for GST

To apply for a GST (Goods and Services Tax) number in India, you can follow these steps

Click Here To apply for GST Registration

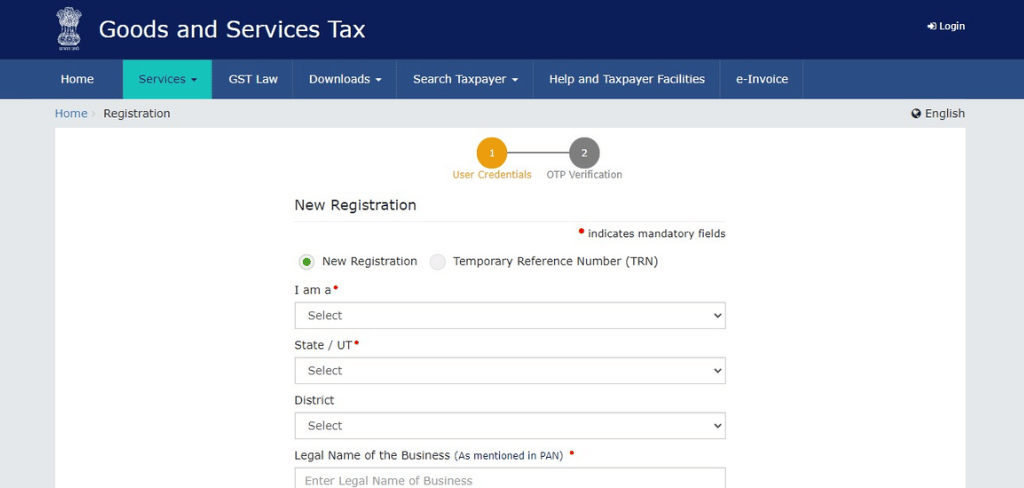

Select Registration: Under the “Services” tab, you will find an option for “Registration.” Click on it.

New Registration: On the “Registration” page, select “New Registration.”

Fill in the Details: The legal name of your company, its PAN (Permanent Account Number), email address, mobile number, and the state in which it is based must all be included.

OTP Verification: You will receive an OTP (One-Time Password) on your registered mobile and email. Enter these OTPs for verification.

Temporary Reference Number (TRN): After verification, a Temporary Reference Number (TRN) will be generated. Note down this TRN.

Complete the Application: Now, return to the GST portal and click on “Services” > “Registration” > “New Registration” again. This time, select the “Temporary Reference Number (TRN)” option.

Enter TRN: Enter the TRN you received and the captcha code, then click “Proceed.”

Fill out the Application Form : Complete the GST registration application form with details about your business, partners/directors, bank account details, and other relevant information.

Upload Documents : You’ll need to upload scanned copies of required documents, such as your business’s PAN card, proof of address, photographs, and bank statements.

Submit Application : After filling out the form and uploading the documents, review the information and submit the application.

ARN Generation : After submission, an Application Reference Number (ARN) will be generated. You can use this ARN to track the status of your application.

Verification : The GST department will verify your application and documents. This process can take a few days to a few weeks.

GSTIN Allotment : You will be given a GST Identification Number (GSTIN) and a certificate of registration once your application is accepted.

Before beginning the registration procedure, have all the necessary paperwork and information ready. As procedures may change over time, it’s also a good idea to speak with a tax expert or check on the official GST portal for any updates or adjustments.

The Key Objectives of GST Registration

For a number of reasons, Goods and Services Tax (GST) registration is required, some are

- If your company exceeds a specific turnover threshold, GST registration is legally required in several nations, including India. There may be fines and legal repercussions if you don’t register.

- Making the GST registration guarantees that your company complies with tax regulations. You can use it to collect GST from your customers, which you must then pay to the government. This aids in preventing tax fraud.

- The GST that registered firms paid on their purchases can be deducted from the GST they collect on sales when they file an input tax credit claim. This lowers the total tax obligation.

- Having your firm registered for GST can increase its reputation, particularly when working with other registered enterprises. It denotes that your company is acknowledged and in compliance with tax laws.

- GST registration is required if your company conducts interstate business. It makes it possible for things to circulate freely across state borders.

- Being GST registered could give you access to government programs, rewards, and contracts that are only open to firms that are registered.

- Penalties and legal actions may follow from failure to comply with GST requirements, such as GST collection without registration.

Overall, GST registration is essential to assuring tax compliance, lowering tax liability, and preserving your company’s legal status. It’s important to check with your local tax office for the particular information that applies to your business as the rules and thresholds can differ from one country to the next.

FAQ’s

How to apply for a Gst number?

Access the GST portal and select the ‘Services’ tab Click ‘Registration’ and then ‘New Registration.’ including PAN, mobile number, and email address. An OTP will be sent to the email and registered mobile.

What is the gst number?

The Goods and Services Tax (GST) number, commonly known as the GSTIN (Goods and Services Tax identifying Number) you must have this number for tax purposes.

How to register for gst?

your nation to register for the Goods and Services Tax. Specify the PAN (Permanent Account Number), company name, contact information, and bank account details that are required for your firm

Is gst registration mandatory?

Depending on your individual situation and local rules, GST (Goods and Services Tax) registration may or may not be required , Registration is often required in many nations that have established GST or comparable consumption-based tax systems